Why Was Federal Withholding Not Taken From My Paycheck?

Why is My Employer Not Withholding Federal Taxes? IRS Policy!

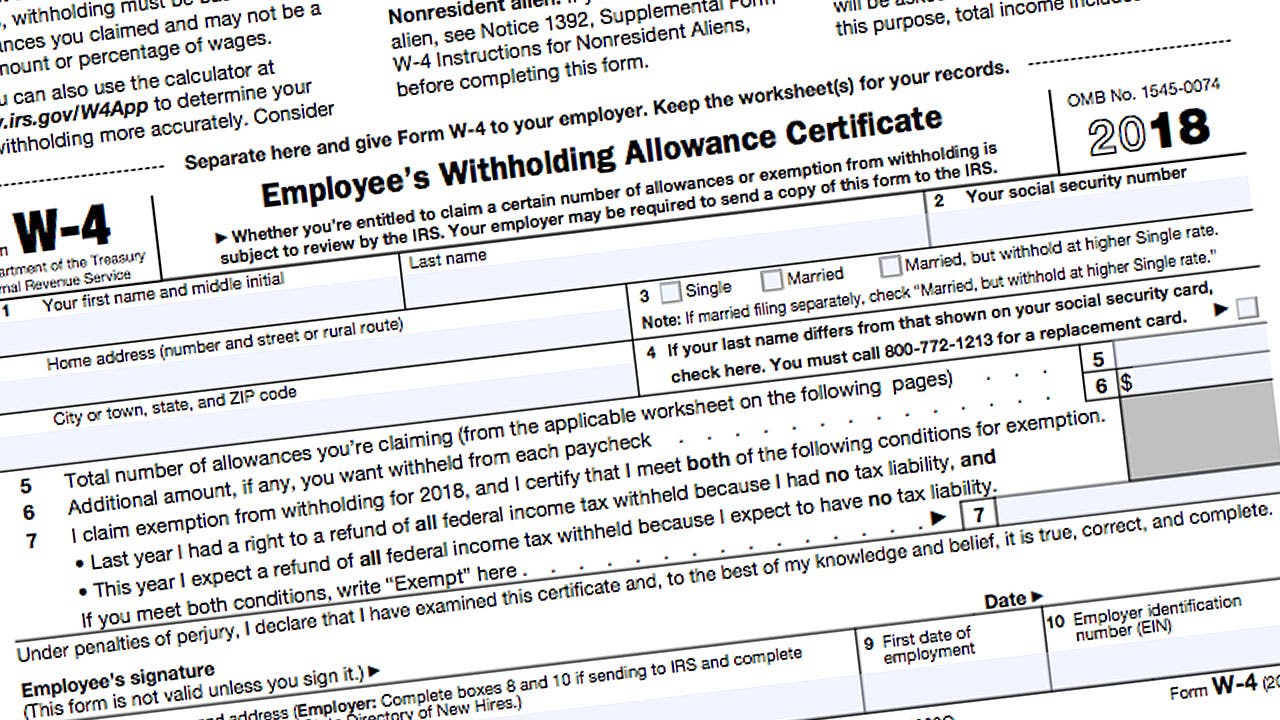

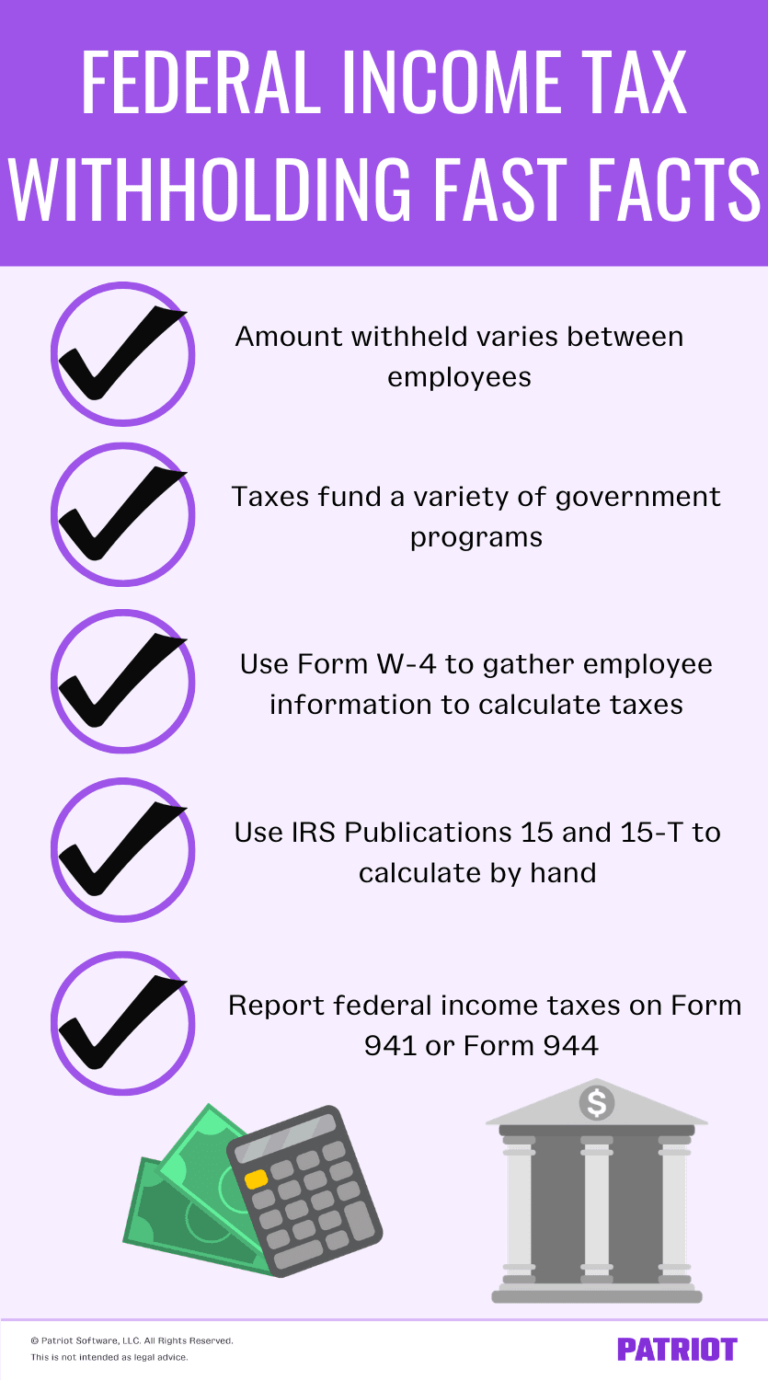

These forms allow HR and payroll to set up the employee's tax withholding. On one of these forms, IRS Form W-4, the employee is asked to provide information that can affect how much tax is withheld. In the past, employees could specify a certain number of "allowances," each one reducing the amount withheld from each paycheck.

Why Was Federal Withholding Not Taken From My Paycheck?

To change your tax withholding you should: Complete a new Form W-4, Employee's Withholding Allowance Certificate, and submit it to your employer. Complete a new Form W-4P, Withholding Certificate for Pension or Annuity Payments, and submit it to your payer. Make an additional or estimated tax payment to the IRS before the end of the year.

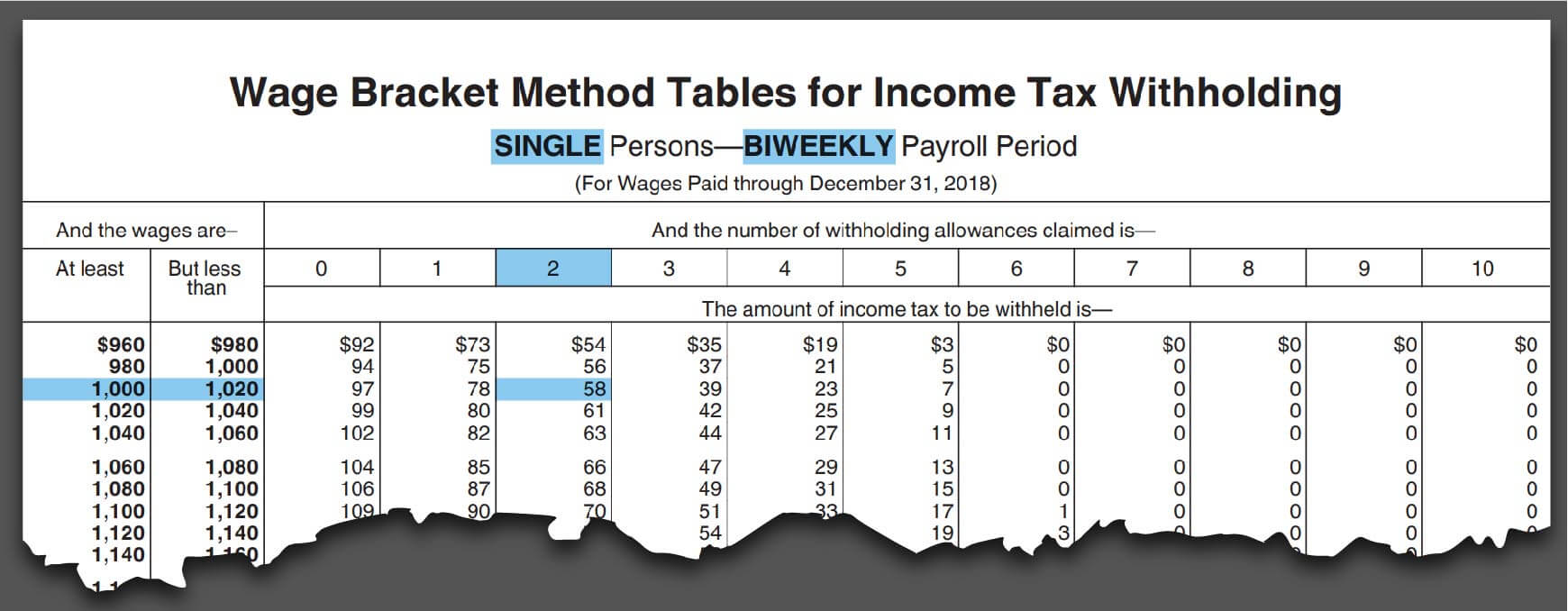

Federal Tax Withholding Tables For Employers Matttroy

Typically, an underpayment penalty may apply if the amount withheld (or paid through estimated taxes) is not equal to the smaller of 90% of the taxes you owe for the current year or 100% of the.

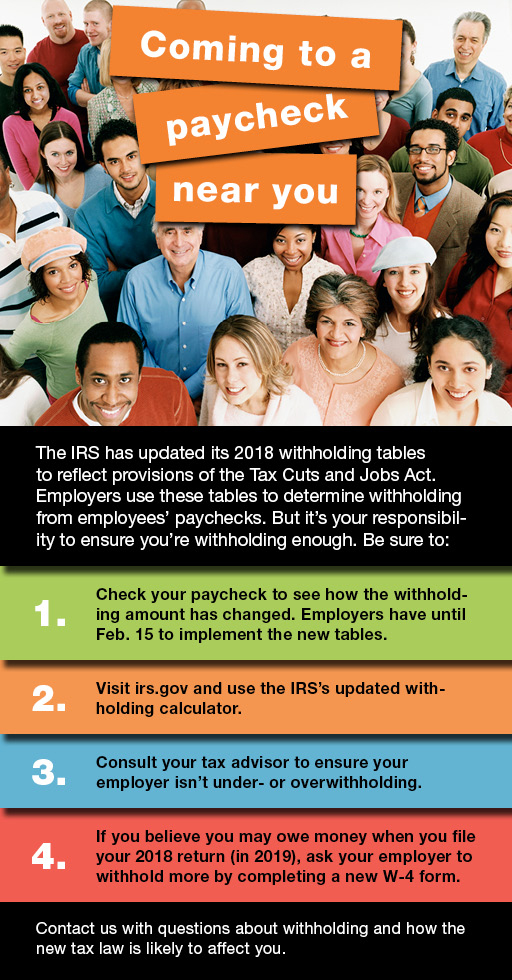

Is Your Employer Withholding Enough in Taxes? Infographic NMS CPA

Pay as you go (PAYG) withholding obligations mainly apply to businesses. You're liable for a penalty if you fail to withhold or pay a PAYG withholding amount when required. This applies, for example, if you're required to: withhold from payments made to employees, directors, office holders or other individuals in various capacities.

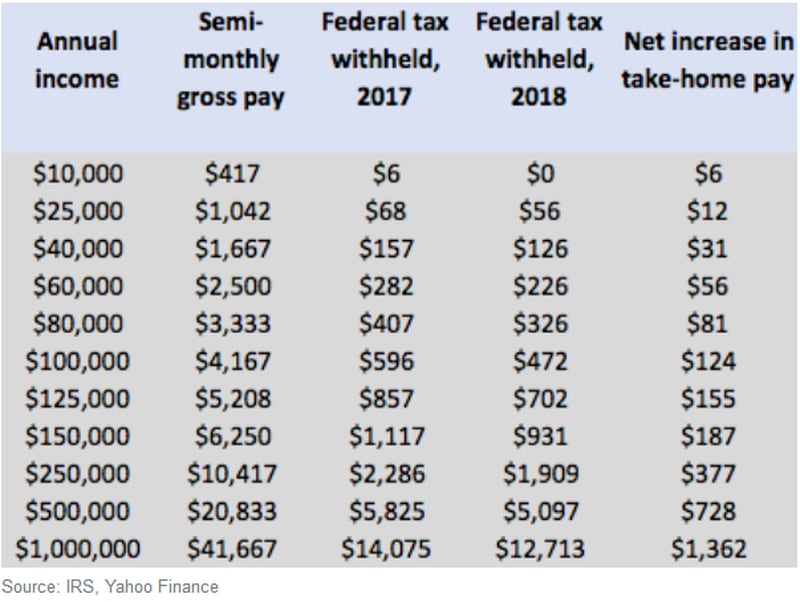

Here's why there's more money in your paycheck

The amount withheld depends on: The amount of income earned and. Three types of information an employee gives to their employer on Form W-4, Employee's Withholding Allowance Certificate : Filing status: Either the single rate or the lower married rate. Number of withholding allowances claimed: Each allowance claimed reduces the amount withheld.

Federal Tax Withholding Employer Guidelines and More

In some situations, taxes might have actually been withheld but the person was given the wrong W-2. In this case, the employer is required to issue a corrected W-2. If the employer made a mistake.

Tax Withholding Changes Can Boost Your Paycheck Kiplinger

If your employer refuses to fix the insufficient withholding, report it to the IRS. Federal withholding refers to the federal income tax and Social Security and Medicare taxes your employer is supposed to take out of your earnings. If enough federal taxes are not withheld, you'll likely owe the Internal Revenue Service when you file your tax.

Did you fail to withhold enough tax in 2018? IRS may have a surprise

I'm seeing a lot of W-2s with virtually no withholding on wages well above the standard deduction, and others with withholding 2-3x the liability. This week I worked with a couple in the midst of divorce. They earned almost $100K combined. He works in a federal agency and therefore is "exempt" from withholding, or so he was told.

Federal Withholding Tax Table For Payroll Review Home Decor

The federal withholding tax has seven rates for 2021: 10%, 12%, 22%, 24%, 32%, 35%, and 37%. The federal withholding tax rate an employee owes depends on their income level and filing status. This all depends on whether you're filing as single, married jointly or married separately, or head of household.

Federal Tax Are You Withholding Enough? Focus HR Inc.

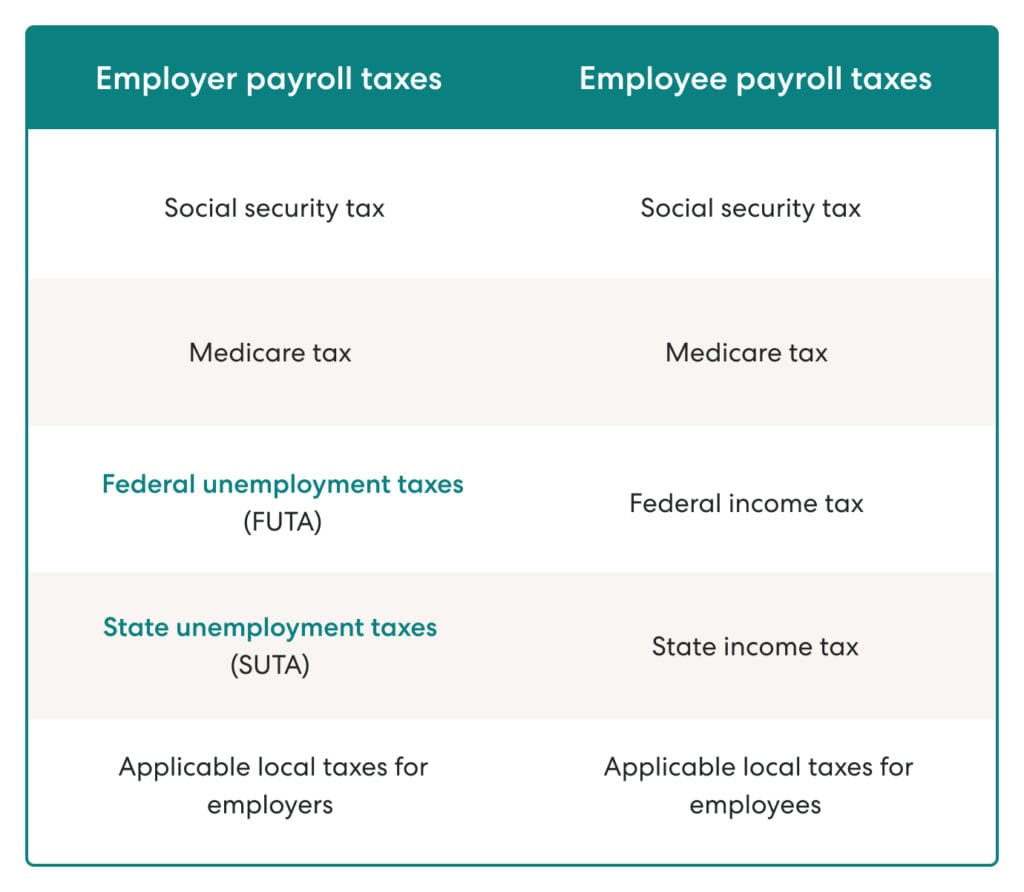

Both employer and employee hold the responsibility for collecting and remitting withholding taxes to the Internal Revenue Service (IRS). For the most part, the employer withholds these taxes on behalf of their employees, but in cases where an employer does not do this, or where an employee is self-employed, it is the responsibility of the employee to pay these withholding taxes.

How To Calculate Federal Tax Withholding

The Federal Income Tax is a tax withheld by the IRS from your paycheck, applying to various forms of income such as employment and capital gains. It helps fund government programs and infrastructure. Reasons for not paying federal income tax include earning below the threshold, being exempt, living and working in different states with tax.

What Is Federal Tax? Withholding Guidelines and More

Most helpful reply. Hi @Ellebrooke, If your employer did not withhold enough tax during one financial year, depending on what other items you have on your tax return you may need to pay us money. Whereas, if you have too much tax withheld once again depending on what other items you have on your tax return you may receive a refund.

:max_bytes(150000):strip_icc()/with-holding-tax-4186749-4d023b8133e443588c8ce795732df79c.jpg)

Withholding Tax Explained Types and How It's Calculated

Click to expand. Key Takeaways. • Form W-4 changed because the Tax Cuts and Jobs Act removed personal exemptions, increased the Standard Deduction, and made the Child Tax Credit available to more people. • As before, you'll need to provide your first and last name, Social Security number, home address, and filing status (Single, Married.

Federal Tax Withholding Employer Guidelines and More

Applying the varied rate on the notice would result in a fortnightly withholding of $225 ($1,500 × 0.15 = $225). Example 2. You receive a variation notice for Tim, one of your payees. The rate of withholding has been varied to 18% of the gross payments listed as salary and overtime. He is paid fortnightly.

Which Employees Are Exempt From Tax Withholding? MCB Advisors

complete a new Form W-4P, Withholding Certificate for Pension or Annuity Payments, and submit it to your payer. make an additional or estimated tax payment to the IRS before the end of the year. Page Last Reviewed or Updated: 01-May-2023. All the information you need to complete a paycheck checkup to make sure you have the correct amount of.

How To Avoid Withholding Tax Economicsprogress5

There's no tax for Head of Household filers with 2 kids ($4,000 in Step 3 on your W-4) until your paychecks are about $55,000/ (number of pay periods). With 3 kids ($6,000 in Step 3) it's $72,000/ (number of pay periods). So until you make that much in a paycheck, there's no withholding as your tax for the year will be $0.